Pippa Stevens

Panic selling not only locks in losses but also puts investors at risk for missing the market’s best days.

Looking at data going back to 1930, Bank of America found that if an investor missed the

S&P 500′s

10 best days in each decade, total returns would be just 91%,

significantly below the 14,962% return for investors who held steady

through the downturns.

The firm noted this eye-popping stat while

urging investors to “avoid panic selling,” pointing out that the “best

days generally follow the worst days for stocks.”

Looking at the

Dow Jones Industrial Average

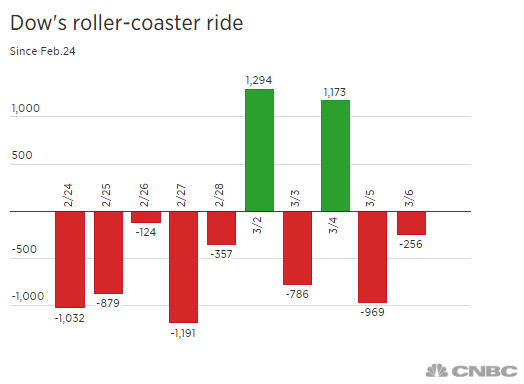

as a reference point, this pattern could be seen playing out this week.

The 30-stock index posted sizable losses on three days this week, but

it also enjoyed the two largest daily point gains on record and ended

the week with a 1.8% gain.

Experts advise investors to avoid the impulse to time the market, which can be difficult even for professional traders.

Still, retail investors like to try. The popular trading app Robinhood recently experienced

“an unprecedented load” that caused outages Monday and Tuesday. The outages prompted outrage on Twitter and

at least one lawsuit from a trader claiming to have missed out on Monday’s rally.

The stock market, meanwhile, remains in correction territory with the major averages all down more than 12% from their highs.

The

Bank of America strategists, led by Savita Subramanian, noted that

corrections are common. The firm said that a correction has occurred

once a year on average since 1928, and that losses are typically

recovered over the subsequent three months.

Additionally, the

strategists don’t see a bear market on the horizon. Currently 53% of the

firm’s bear market signposts are triggered. The list includes factors

like consumer confidence and monetary policy. Since 1960, more than 80%

have been triggered ahead of prior market peaks.

That said, as

the coronavirus outbreak continues to roil global markets, the firm is

not as bullish as it was. On Monday, it cut its 2020 earnings per

share estimate on the S&P 500 by 5%, while also

lowering its 2020 year-end target on the index to 3,100.

“Negative

headlines and panic selling are not good reasons to sell, but the

coronavirus outbreak is now meaningfully impacting fundamentals,” the

firm said.

For investors who feel they have to do something during

downturns, TD Ameritrade chief market strategist JJ Kinahan advises to

make only small moves. “The problem most people have is they think all

or none: think partials,” he said.

“This also goes for the

opportunities in the market. That is, if you see a stock at a level you

like, you could buy some but perhaps not all,” he added. “If the stock

goes down you have an opportunity to buy more at a better price.”

- Michael Bloom contributed reporting.

Join Geezgo for free. Use Geezgo's end-to-end encrypted Chat with your Closenets (friends, relatives, colleague etc) in personalized ways.>>

Comments

Post a Comment